Unearth Savings: A Comprehensive Overview of Repossessed Storage Buildings

Understanding Repossessed Storage Buildings

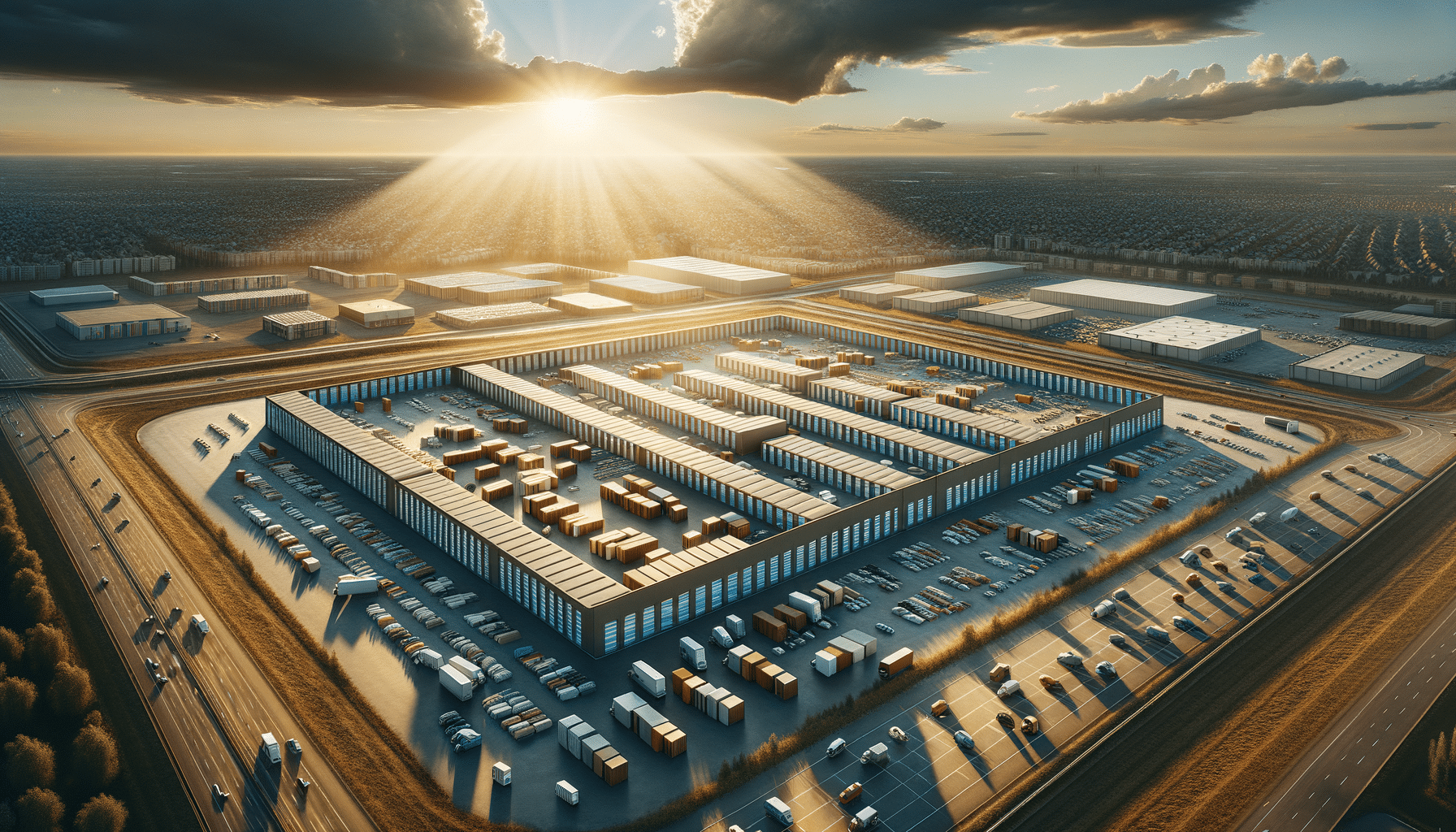

Repossessed storage buildings are structures that have been reclaimed by lenders or financial institutions due to default on payments by the original owners. These buildings, often used for storage or commercial purposes, present a unique opportunity for buyers looking for cost-effective solutions. The market for repossessed storage buildings has grown significantly, driven by economic fluctuations and the need for affordable space. Understanding the dynamics of this market is crucial for anyone considering an investment in these properties.

Repossessed storage buildings come in various forms, including portable units, prefabricated structures, and traditional warehouses. They are often sold at a fraction of their original cost, making them an attractive option for small businesses, startups, and individuals seeking additional storage space. The appeal lies in their affordability and the potential for customization to suit specific needs.

However, purchasing a repossessed storage building requires careful consideration. Buyers must assess the condition of the building, its location, and any potential legal or financial encumbrances. Engaging with professionals, such as real estate agents or legal advisors, can provide valuable insights and help navigate the complexities of the purchase process.

The Economic Benefits of Repossessed Storage Buildings

One of the primary advantages of purchasing repossessed storage buildings is the cost savings. These structures are typically sold at auction or through direct sales by financial institutions at significantly reduced prices. This affordability makes them an excellent option for businesses and individuals looking to minimize expenses while acquiring necessary space.

Furthermore, repossessed storage buildings can offer long-term financial benefits. By investing in these properties, buyers can avoid the high costs associated with new construction or leasing commercial space. Additionally, owning a storage building provides the potential for rental income, as these structures can be leased to other businesses or individuals in need of storage solutions.

The economic benefits extend beyond the initial purchase price. Repossessed buildings often require minimal renovation, allowing buyers to quickly adapt them for use. This can result in faster returns on investment and reduced operational costs. Moreover, the flexibility in design and usage makes these buildings suitable for a wide range of applications, from warehousing to retail operations.

Potential Challenges and Considerations

While the benefits of repossessed storage buildings are numerous, potential buyers must also be aware of the challenges involved. One of the primary concerns is the condition of the building. Repossessed properties may have been neglected or poorly maintained, necessitating repairs or renovations before they can be used effectively.

Another consideration is the location of the building. The value and utility of a storage building are heavily influenced by its geographical position. Buyers should evaluate the accessibility, proximity to major transportation routes, and the potential for future development in the area. A well-located building can enhance business operations and increase the property’s value over time.

Legal and financial due diligence is essential when purchasing repossessed properties. Buyers should ensure that there are no outstanding liens or legal issues associated with the building. Consulting with legal professionals and conducting thorough research can help mitigate these risks and ensure a smooth transaction.

Creative Uses for Repossessed Storage Buildings

The versatility of repossessed storage buildings allows for a myriad of creative uses beyond traditional storage. Entrepreneurs and business owners can repurpose these spaces to suit various innovative applications, maximizing their investment and creating unique business opportunities.

For instance, many businesses have transformed storage buildings into retail spaces, art studios, or community centers. The open layout and customizable nature of these structures make them ideal for such conversions. Additionally, the affordability of repossessed buildings allows for investment in interior design and branding, enhancing the customer experience.

Another popular trend is the conversion of storage buildings into co-working spaces. With the rise of remote work and freelancing, there is a growing demand for flexible and affordable office environments. Repossessed storage buildings can be adapted to create collaborative workspaces, complete with meeting rooms, shared facilities, and networking areas.

These creative uses not only add value to the property but also contribute to local economic growth by fostering entrepreneurship and innovation. By thinking outside the box, buyers can unlock the full potential of repossessed storage buildings and create thriving business ventures.

Conclusion: The Strategic Advantage of Investing in Repossessed Storage Buildings

Investing in repossessed storage buildings offers a strategic advantage for individuals and businesses seeking cost-effective and versatile space solutions. The economic benefits, coupled with the potential for creative applications, make these properties a valuable addition to any real estate portfolio.

However, success in this market requires careful planning and consideration. Prospective buyers must conduct thorough research, engage with professionals, and evaluate the condition and location of the building. By addressing these factors, investors can mitigate risks and maximize the return on their investment.

Ultimately, repossessed storage buildings represent an untapped resource with significant potential. By exploring these opportunities, buyers can secure affordable space, foster innovation, and contribute to economic growth in their communities.