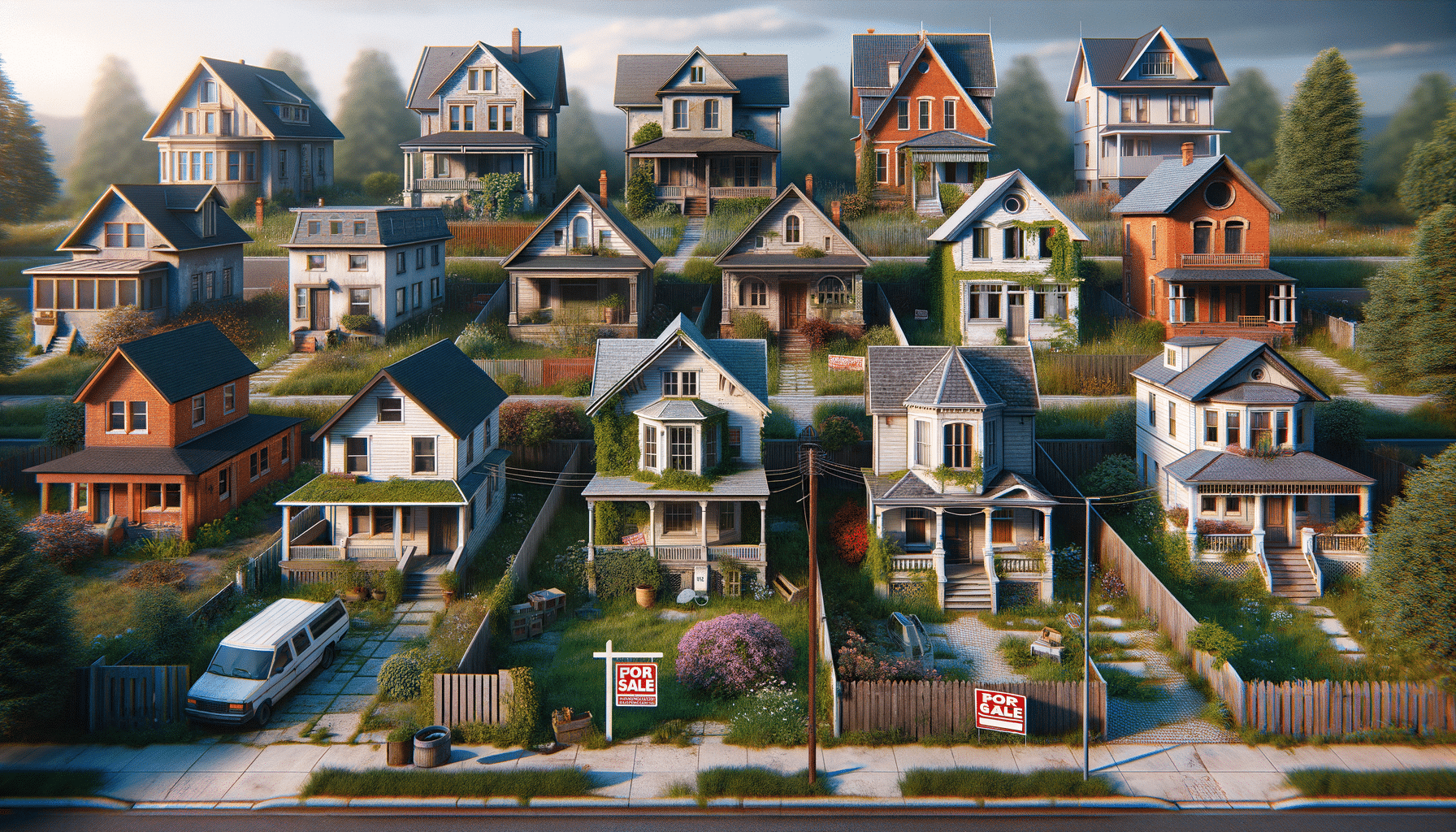

A Comprehensive Guide to Nearby Foreclosed Homes

Understanding Foreclosed Properties

Foreclosed properties represent a unique segment of the real estate market, offering potential buyers a chance to purchase homes at significantly reduced prices. These properties become available when homeowners fail to meet mortgage obligations, leading lenders to repossess and sell the homes. Understanding the intricacies of foreclosures is vital for anyone looking to invest in this market.

The foreclosure process typically involves several stages: pre-foreclosure, auction, and real estate owned (REO) properties. Each stage presents different opportunities and challenges for buyers. Pre-foreclosure offers the chance to negotiate directly with homeowners, potentially avoiding the competitive auction process. Auctions, on the other hand, can be fast-paced and require due diligence to ensure a sound investment. REO properties, owned by lenders, are often sold at a discount but may require additional repairs or maintenance.

Investing in foreclosed properties can be lucrative, but it’s essential to conduct thorough research. Potential buyers should consider factors such as property condition, market trends, and legal obligations. Additionally, working with a knowledgeable real estate agent or attorney can provide valuable insights and guidance throughout the process.

Exploring the Advantages of Buying Foreclosed Homes

Purchasing a foreclosed home can offer several advantages to savvy buyers. One of the most appealing benefits is the potential for significant cost savings. Foreclosed properties are often priced below market value, allowing buyers to acquire homes at a fraction of the cost. This can be especially attractive for first-time homeowners or investors looking to expand their portfolios.

Another advantage is the possibility of building equity quickly. By purchasing a home at a lower price, buyers have the opportunity to increase the property’s value through renovations or market appreciation. This can lead to substantial returns on investment over time. Additionally, foreclosed homes can provide access to desirable neighborhoods that may otherwise be out of reach financially.

However, it’s important to approach foreclosed properties with caution. Buyers should be prepared for potential challenges, such as property damage or legal issues. Conducting thorough inspections and working with professionals can help mitigate these risks and ensure a successful purchase.

Challenges and Risks of Foreclosed Properties

While foreclosed properties offer numerous opportunities, they also come with inherent risks and challenges. One of the primary concerns is the condition of the property. Many foreclosed homes have been neglected or vandalized, resulting in costly repairs and maintenance. Buyers should budget for these expenses and consider the overall investment before proceeding.

Legal complications can also arise when purchasing foreclosed properties. Issues such as liens, unpaid taxes, or disputes over ownership can complicate the buying process. It is crucial to conduct a thorough title search and work with legal professionals to address any potential obstacles.

Another challenge is the competitive nature of the foreclosure market. Auctions can be highly competitive, with multiple bidders driving up prices. To succeed, buyers must be prepared to act quickly and decisively, often with cash offers. This requires careful planning and financial readiness.

Strategies for Successfully Purchasing Foreclosed Homes

To navigate the complex landscape of foreclosed properties, buyers can employ several strategies to increase their chances of success. First, conducting thorough research is essential. Understanding local market trends, property values, and the foreclosure process can provide a competitive edge.

Working with experienced professionals, such as real estate agents or attorneys, can also be beneficial. These experts can offer valuable insights, negotiate on behalf of the buyer, and help navigate potential legal hurdles. Additionally, attending foreclosure auctions and networking with industry professionals can provide firsthand knowledge and opportunities.

Another effective strategy is to secure financing in advance. Having pre-approved financing or cash on hand can make offers more attractive to sellers and expedite the purchasing process. Buyers should also consider setting a budget and sticking to it, avoiding the temptation to overbid in competitive situations.

Conclusion: Navigating the Foreclosure Market

The landscape of foreclosed properties offers a wealth of opportunities for those willing to invest time and effort into understanding the market. By exploring the advantages and challenges, potential buyers can make informed decisions and capitalize on the benefits of purchasing foreclosed homes.

While the process can be complex and competitive, employing strategic approaches and working with knowledgeable professionals can enhance the likelihood of a successful transaction. Ultimately, foreclosed properties can provide a path to homeownership and investment gains, making them a compelling option for discerning buyers.