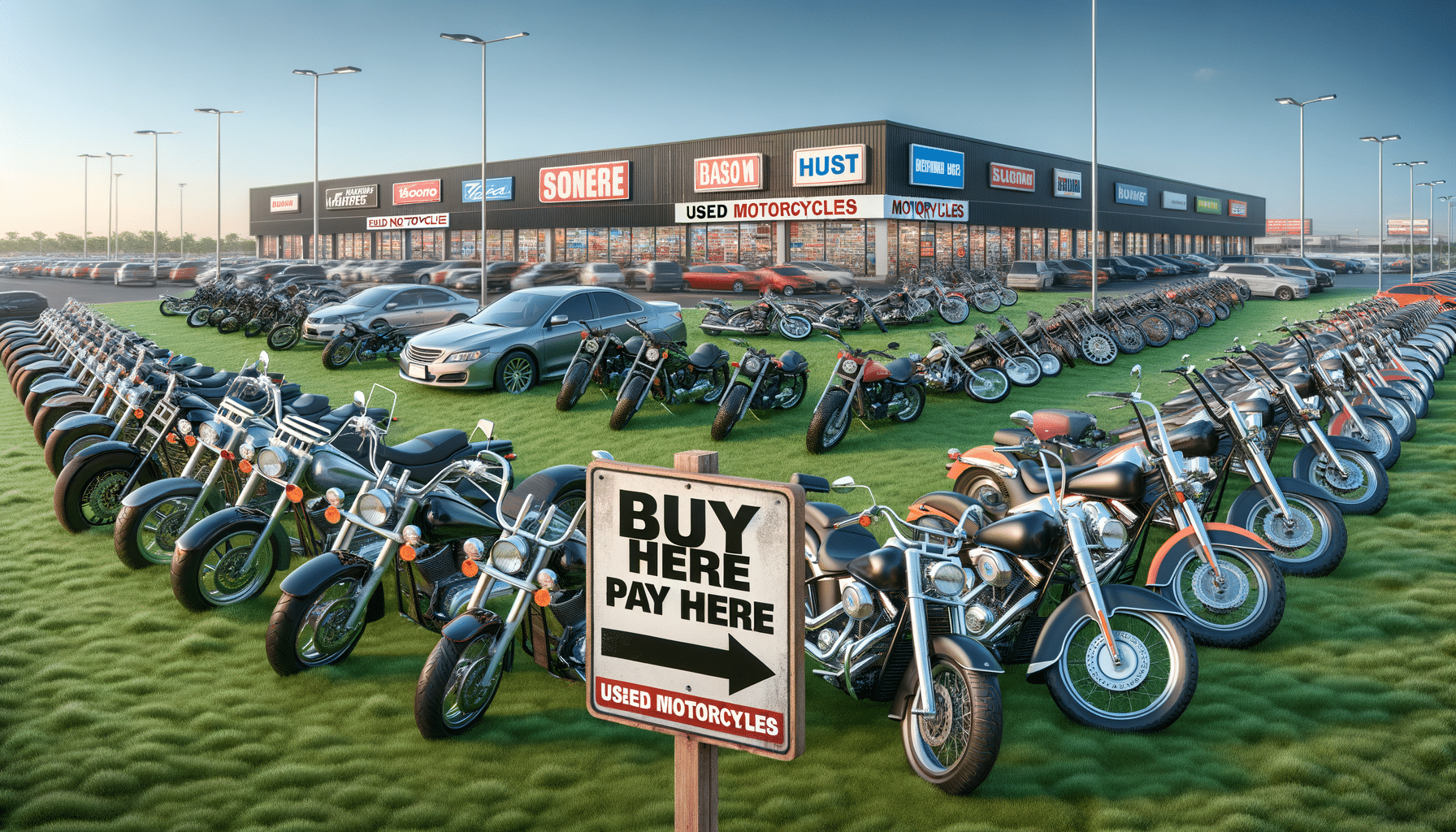

Exploring Buy Here Pay Here Used Motorcycles: A Comprehensive Guide

Understanding Buy Here Pay Here Motorcycle Dealerships

Buy Here Pay Here (BHPH) motorcycle dealerships offer a unique financing option tailored for those who might face challenges with traditional lending. Unlike conventional dealerships that rely on third-party financial institutions, BHPH dealers provide in-house financing. This means that the dealership itself acts as the lender, making it easier for individuals with credit issues to secure a motorcycle.

The appeal of BHPH dealerships lies in their flexibility. Traditional lenders often require a good credit score, which can be a barrier for many potential buyers. BHPH dealerships, on the other hand, prioritize the buyer’s current employment status and ability to make payments over their credit history. This opens the door for many to own a motorcycle who otherwise might not qualify for standard loans.

However, it’s essential to understand the trade-offs. BHPH financing typically comes with higher interest rates to offset the risk the dealership takes on. Buyers should be prepared for potentially larger monthly payments and ensure they can meet these financial commitments. Despite these higher costs, the convenience and accessibility of BHPH financing can make it an attractive option for those looking to hit the road on two wheels.

- Key Advantage: In-house financing without the need for a strong credit score.

- Consideration: Higher interest rates compared to traditional loans.

- Flexibility: Focus on current employment and payment capacity.

Benefits of Choosing a BHPH Motorcycle Dealership

Opting for a BHPH dealership offers several benefits that can be particularly advantageous for certain buyers. One of the most significant advantages is the simplification of the purchasing process. With financing and purchasing handled under one roof, buyers can avoid the lengthy approval processes typical of banks and credit unions.

Moreover, BHPH dealerships often provide a wide range of used motorcycles, catering to various preferences and budgets. This variety allows buyers to select a bike that suits their style and financial situation. Additionally, the in-house financing model can help buyers build or improve their credit score. Regular, on-time payments reported to credit bureaus can gradually enhance a buyer’s credit profile, opening doors to more favorable financing options in the future.

Another benefit is the personalized service. BHPH dealerships are typically smaller than traditional dealerships, allowing for a more tailored customer experience. Sales staff are often more willing to work closely with buyers to find a financing plan that fits their unique circumstances. This personalized approach can make the buying process less intimidating and more supportive.

- Streamlined Process: Purchase and finance under one roof.

- Variety: Wide selection of used motorcycles.

- Credit Building: Opportunity to improve credit with timely payments.

Considerations Before Opting for BHPH Financing

While BHPH financing offers convenience and accessibility, potential buyers should carefully consider several factors before committing. One of the primary considerations is the cost. As mentioned, interest rates at BHPH dealerships are often higher than those offered by traditional lenders. This means that over the life of the loan, buyers may end up paying significantly more for their motorcycle.

It’s also crucial to assess the dealership’s reputation. Not all BHPH dealerships operate with the same level of transparency and integrity. Prospective buyers should research reviews and possibly seek recommendations to ensure they are dealing with a reputable dealer. Understanding the terms of the financing agreement is equally important. Buyers should be fully aware of the interest rates, payment schedules, and any potential penalties for late payments.

Another consideration is the condition of the motorcycle being purchased. Since BHPH dealerships primarily sell used motorcycles, buyers should conduct thorough inspections and possibly seek a professional mechanic’s opinion to avoid unexpected maintenance costs. Ensuring the motorcycle is in good condition can prevent future headaches and expenses.

- Higher Costs: Be prepared for elevated interest rates.

- Dealer Reputation: Research and choose a reputable dealership.

- Vehicle Condition: Inspect thoroughly to avoid future issues.

Comparing BHPH with Traditional Motorcycle Financing

When deciding between BHPH and traditional financing, it’s essential to weigh the pros and cons of each option. Traditional financing typically offers lower interest rates, which can result in significant savings over the loan term. However, the stringent credit requirements can be a barrier for some buyers. In contrast, BHPH financing provides an accessible alternative for those who may not meet these requirements.

Another aspect to consider is the flexibility of the financing terms. Traditional lenders often have fixed terms and conditions, which might not be suitable for everyone. BHPH dealerships, on the other hand, may offer more flexible payment plans tailored to the buyer’s financial situation. This flexibility can be a deciding factor for those with irregular income or other financial commitments.

Ultimately, the choice between BHPH and traditional financing depends on the buyer’s individual circumstances. Those with a strong credit history and stable financial situation may benefit more from traditional financing. However, for those facing credit challenges, BHPH provides a viable path to motorcycle ownership, albeit at a higher cost.

- Interest Rates: Lower with traditional financing, higher with BHPH.

- Credit Requirements: Stricter with traditional lenders, more lenient with BHPH.

- Flexibility: BHPH often offers more personalized payment plans.

Conclusion: Is BHPH Right for You?

Choosing to purchase a motorcycle through a BHPH dealership is a decision that requires careful consideration of one’s financial situation and needs. While BHPH offers flexibility and accessibility to those with less-than-perfect credit, it comes with higher costs and potential risks. Buyers should weigh these factors against the benefits of traditional financing, such as lower interest rates and potentially better terms.

For individuals who find themselves unable to secure a loan through conventional means, BHPH provides a valuable alternative. It allows them to enjoy the freedom and convenience of motorcycle ownership while working towards improving their credit score. However, it’s crucial to approach this option with due diligence, ensuring the dealership is reputable and the motorcycle is in good condition.

Ultimately, the decision to go with BHPH financing should be based on a thorough assessment of personal financial health, the reputation of the dealership, and the terms of the financing agreement. With careful planning and consideration, BHPH can be a viable path to achieving the dream of owning a motorcycle.

- Assess Financial Health: Ensure you can meet higher payment obligations.

- Dealership Reputation: Choose a trustworthy dealer.

- Financing Terms: Understand and agree to the terms before committing.