Exploring the World of Repossessed RVs: A Comprehensive Guide

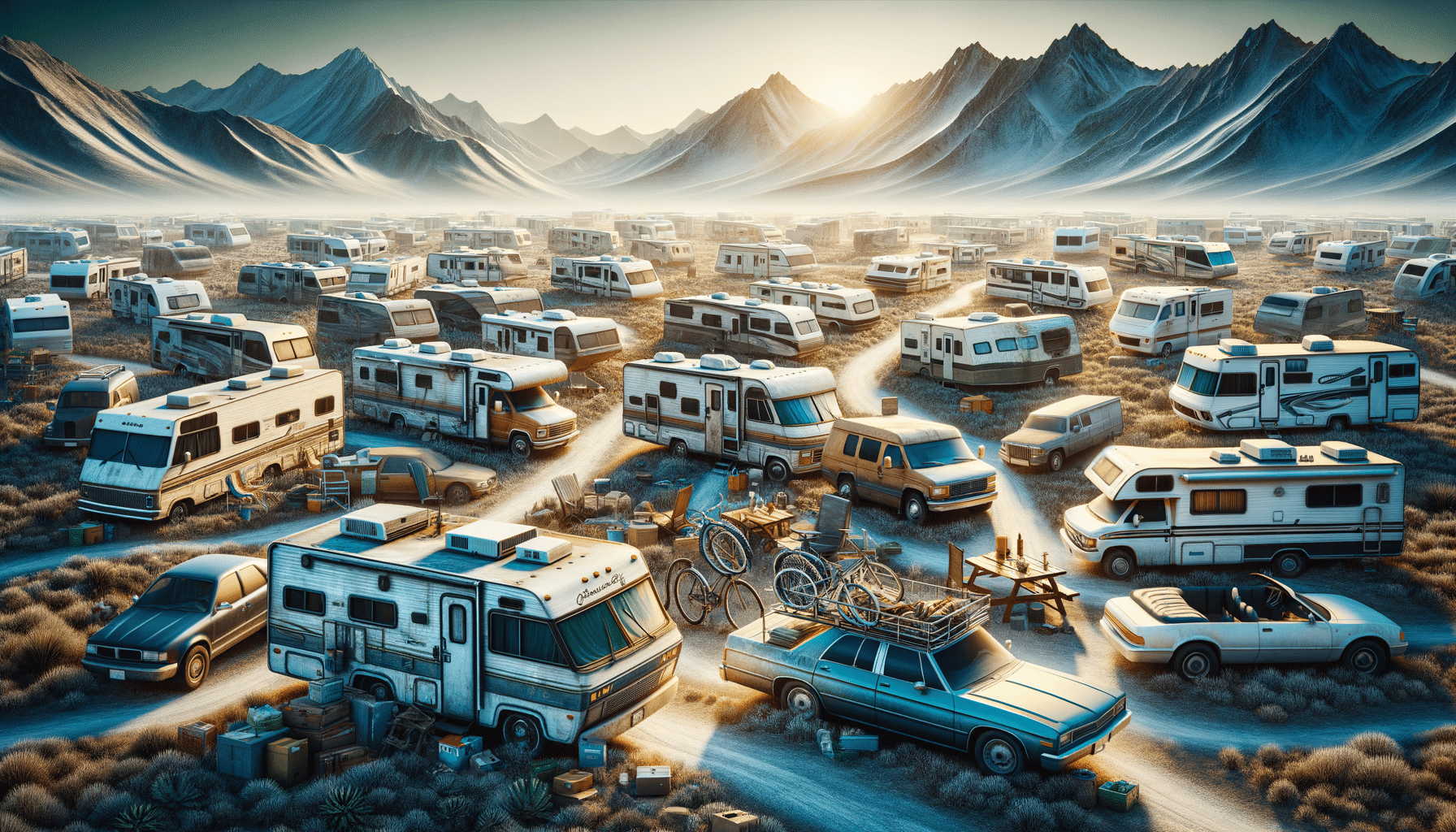

Repossessed RVs offer a unique opportunity for adventurous buyers looking for affordable travel options.

Understanding Repossessed RVs

Repossessed RVs are recreational vehicles that have been taken back by lenders due to the original owner’s inability to fulfill their financial obligations. This often occurs when the owner defaults on loan payments, leading the bank or financial institution to reclaim the vehicle. For potential buyers, this scenario can present a unique opportunity to purchase an RV at a reduced price. However, it’s essential to understand the intricacies of buying a repossessed RV to make an informed decision.

One of the primary advantages of purchasing a repossessed RV is the cost savings. These vehicles are typically sold at auction, where they can be acquired for significantly less than their market value. The main reason for this price reduction is the lender’s desire to recoup some of their losses quickly. However, buyers should be aware that the condition of repossessed RVs can vary widely. Some may be in excellent shape, while others might require substantial repairs.

It’s crucial to conduct thorough research and inspections before purchasing a repossessed RV. Potential buyers should consider hiring a professional inspector to assess the vehicle’s condition. Additionally, understanding the auction process and setting a firm budget can help avoid overspending. By taking these steps, buyers can enjoy the benefits of owning an RV without the hefty price tag typically associated with new models.

The Auction Process for Repossessed RVs

The auction process for repossessed RVs can be both exciting and daunting for newcomers. Auctions are the primary method through which financial institutions sell repossessed vehicles, and they can be conducted either online or in person. Understanding how these auctions work is crucial for anyone considering this route.

Before attending an auction, it’s essential to research the specific rules and procedures of the event. Each auction house may have different requirements for registration, bidding, and payment. Familiarizing oneself with these details can prevent any surprises on auction day. Additionally, prospective buyers should review the list of available RVs and prioritize those of interest.

During the auction, it’s easy to get caught up in the excitement of bidding. However, it’s crucial to remain disciplined and adhere to a predetermined budget. Bidding wars can quickly escalate, leading to overspending. To avoid this, set a maximum bid for each RV and stick to it. Also, consider attending a few auctions as an observer before participating to gain a better understanding of the process.

Evaluating the Condition of Repossessed RVs

Evaluating the condition of a repossessed RV is a critical step in the purchasing process. Since these vehicles are often sold “as-is,” buyers need to be vigilant in assessing their condition to avoid unexpected repair costs. This assessment should include both a visual inspection and a mechanical evaluation.

During the visual inspection, look for signs of wear and tear, such as dents, rust, and water damage. Check the roof, windows, and seals for leaks, as water damage can lead to costly repairs. Inside the RV, inspect the furniture, appliances, and plumbing systems. Ensure everything is in working order, or at least identify what needs fixing.

For the mechanical evaluation, consider hiring a professional RV mechanic. They can provide a comprehensive assessment of the engine, transmission, brakes, and electrical systems. This step is especially important if the RV has been sitting idle for an extended period, as inactivity can lead to mechanical issues.

By thoroughly evaluating the condition of a repossessed RV, buyers can make informed decisions and potentially save thousands of dollars on repairs.

Financing Options for Repossessed RVs

Financing a repossessed RV can be different from financing a new or used RV purchased from a dealership. While some banks and credit unions offer loans specifically for repossessed vehicles, the terms and conditions may vary. Understanding these options is essential for buyers who require financing.

One option is to secure a loan through a financial institution that specializes in RV financing. These lenders often have experience dealing with repossessed vehicles and can offer competitive rates. However, buyers should be prepared for potentially higher interest rates due to the perceived risk associated with repossessed RVs.

Another alternative is to explore personal loans, which can be used for any purpose, including purchasing a repossessed RV. While personal loans may offer more flexibility, they often come with higher interest rates than traditional RV loans.

For those with the means, paying cash for a repossessed RV can eliminate the need for financing altogether. This option can provide significant savings over time, as it avoids interest charges. Regardless of the financing method chosen, it’s crucial to compare offers from multiple lenders to secure the most favorable terms.

Pros and Cons of Buying a Repossessed RV

Purchasing a repossessed RV comes with its own set of advantages and disadvantages. Understanding these can help buyers make informed decisions and determine if this option aligns with their needs and expectations.

One of the primary benefits of buying a repossessed RV is the potential for significant cost savings. These vehicles are often sold below market value, making them an attractive option for budget-conscious buyers. Additionally, the wide variety of available models means there’s likely an RV to suit every traveler’s needs.

However, there are also potential downsides to consider. Repossessed RVs are typically sold “as-is,” meaning buyers are responsible for any repairs or maintenance needed. This can lead to unexpected expenses, especially if the RV has been neglected or improperly maintained. Furthermore, the auction process can be competitive and fast-paced, which may not be suitable for all buyers.

In summary, while repossessed RVs offer an affordable entry point into RV ownership, they require careful consideration and due diligence. By weighing the pros and cons, buyers can make informed choices that align with their travel goals and financial situation.